- Accept card payments – lowest rates from 0.27%

- Keep your card processing fees to a minimum

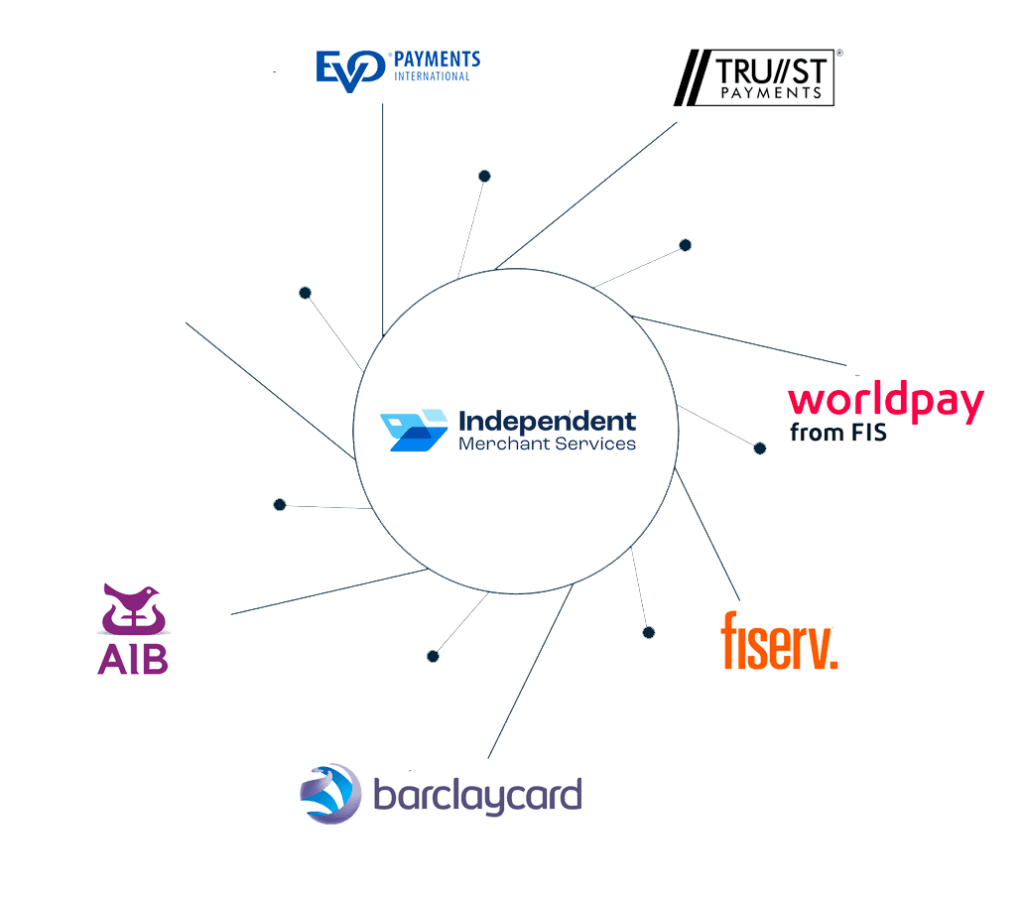

- Direct access to the UK’s leading card processing banks

- We ensure your rates always remain competitive

Fill in this quick form to get started

No spam emails or calls

Do you already take card payments?

Who is your current provider?

Payment Types Required

Choose from the payment methods then click Next

Monthly Turnover

What's your turnover each month?

Company Details

Enter the name of your company

Company Details

Enter your company's postcode and contact number

Thank You!

We'll be in touch shortly.

Step 1

Once you fill in our form we’ll simply contact you for a 5-minute chat to understand exactly what you want and how we can help.

Step 2

After the brief discovery call with one of our payment consultants, you’ll receive the latest and most competitive quotes tailored to your specific needs.

Step 3

Compare offers from our tried and tested providers and decide which is the best for your business.

Here’s what some of our recent clients have had to say about us

Compare preferential rates on all types of card payments

We have significant leverage and buying power with payment processors due to the volume of businesses we deal with (the businesses we’ve helped process well in excess of a billion pounds annually on cards).

Our buying power and long-established relationships with 90% of the UK’s payment providers mean we can typically secure significantly lower payment processing rates than you would be offered going direct.

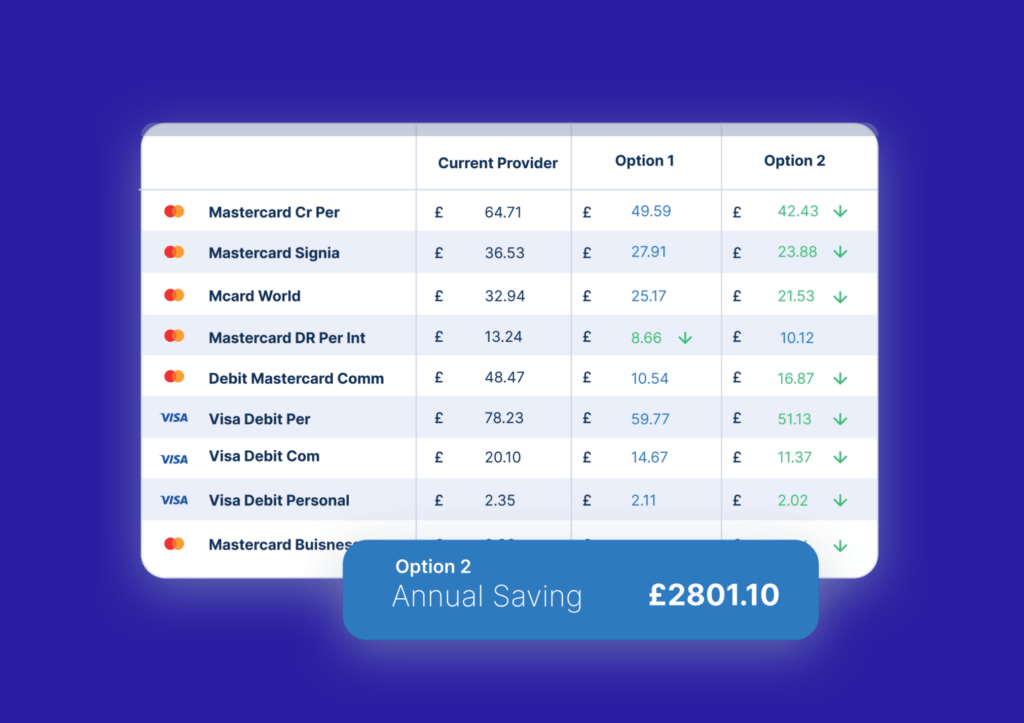

Are Your Card Fee Charges Competitive Enough?

Simply upload a recent and typical statement from your current card payment provider

We will email you back with our independent observations on your current rates

NB we do not share your details with any third parties

One expert source to provide independent advice on the best payment processors, contract terms and transaction fees for your specific business

As well as saving you time and hassle, our payment experts will ensure you are not overcharged or tied to punitive contract terms.

Avoid rate increases mid-contract, hidden charges not highlighted before signing up, poor after-sales service, expensive exit penalties or punctuative roll-over agreements.

What’s in it for everyone?

- We get paid a small introducers fee from the banks.

- The bank gets a new customer.

- You get a great deal and maximise your cost savings.

- You also have us as back up during your agreement with the provider.

Reduce credit card processing fees on all payment channels

Whether you want to accept payments in person, online, over the phone or combine them all in an omnichannel solution, we can help you find the best solution at extremely competitive rates.

In-Person Payments

Avoid technical jargon to get an online payment solution that’s right for your business.

- We typically recommend Ingenico or Pax payment terminals

- We can offer advice and fee reduction services for all card machines (countertop, portable and mobile) and EPOS systems.

- Card machine contracts are 18 months max and typically range from £10–£25 +VAT per month.

Online Payments

Avoid technical jargon and get an online payment solution that’s right for your business.

- Ecommerce solutions ranging from simple hosted payment gateways to highly customisable gateways integrated into your website via API.

- Retain your existing payment gateway / ecommerce platform and integrate with a cheaper merchant account provider.

- Pay by link, recurring payments and open banking options are also available.

Phone Payments

Easy to use virtual terminal solutions to take payments over the phone or via mail order.

- Process electronic payments via telephone, email and mail order.

- No website required. Use the virtual terminal on a mobile, tablet or PC.

- Fully PCI compliant with Address Verification System (AVS).

- The costs can range from £0 per month to £20 per month but the processing rates are where the main savings will be made.

Common questions

Why shouldn’t I go direct to payment processors?

We use the buying power of thousands of enquiries to ensure the providers sharpen their pencil on rates. If the banks don’t offer you great deals, then you don’t sign up and we don’t get paid a penny.

So like you we are just as keen to see you get a great deal and we are confident we can achieve much better and more competitive rates than most business owners can by going direct.

The market is always changing and we are usually the first to hear about the genuine latest offers from the major payment processors. In the unlikely event that you have a better deal, let us compare like for like. We don’t like to be beaten.

Are we really the payment experts?

This is all we do, 40 hours a week and we have been doing this for 12 years so we know about merchant services like you know your own business.

If we can’t make genuine and real value savings then that will be because you are already on great rates and of course we will tell you this.

Why can’t you give me rates online?

We have to verify and understand what you require before directing you to the right provider and the best deals. There’s more to merchant services than just the debit and credit card processing fees and so many providers charge additional hidden fees or can also increase your rates mid contract.

We are here to ensure you get good service and competitive charges not just now but all through your agreement with the provider of your choice.

Will you help me review contracts or quotes?

Yes. Just send us a recent statement from your current provider or any quotes you have already received and we will independently review contractual terms and conditions and advise you of any potential pitfalls such as:

- Set up fees

- Authorisation fees

- PCI compliance charges

- Non Compliance Fees

- Minimum Monthly service charges

- Premium charges

- Moto additional charges

- Contract termination penalties

- Length of the contract

- Contract renewal rollovers

How long does it take to onboard with a new provider?

Most applications take around 3 days for the bank’s underwriting to approve and then two days to send out terminals. The provider that offers the quickest delivery isn’t always the most competitive.

Do you offer support during the switching process?

Yes. We manage the whole process from start to finish. Like switching energy providers, it’s seamless and hassle-free with no interruption to your business.

Will you share my contact details?

Unlike most lead generation comparison websites, we don’t sell your details to anyone. One of our in-house payment experts will contact you to discuss your requirements, give you some indicative rates and sometimes recommend special offers available to our clients from selected payment providers.

With our 5-star Trustpilot service, we are here to help you compare providers and if you sign up with one of our recommendations also provide ongoing support.

Who do I contact if I have an issue with the payment provider?

If you have an issue after signing up with one of the merchant service providers we recommended, your first port of call is their customer support team (as your contract is with them).

However, in the event they are unable to resolve your issue(s) to your satisfaction, we ask you to report the complaint to us. We will step in to help resolve the matter.

(No spending hours on the phone waiting for help!)

Do you work with high-risk providers?

Yes. We have high-risk providers that can offer competitive rates and terms of settlement that are more appealing than can be offered from mainstream card payment providers.

Don’t waste your time completing applications with mainstream acquiring banks that will simply decline your application, offer poor rates or apply restrictions and deferred payments.

If your company operates in any of the categories below then contact us to discuss your options:

- Crypto Currencies, Bitcoin transactions

- Peer to Peer lending

- Forex

- Remittance

- Alcohol

- Affiliate Marketing

- Tobacco & E-Cigarettes

- Nutraceuticals

- Airline, Travel, Tourism & Lodging

- Debt Management & Collection Agencies

- Payday Loans Merchant

- Gambling Merchant

- Foreign Exchange

- Private Clubs

- Dating & Escort Services

- Adult Entertainment

- Timeshares & Holiday Clubs

- Tech Support

- Charities

- Monthly Membership

- Subscription Services

- Insurance

- Jewellery

- Stamps & Coins

- Software

- Advertising Services

- Online Auctions

- Events & Tickets